Sector Shuffle: Same Players, New Positions

The past week brought an unusual shake-up in the RRG sector ranking model. While the composition of the top five sectors, and thus the bottom six, remained unchanged, every single position in the entire ranking shifted — a rare occurrence that sets the stage for what’s likely to be another interesting week ahead.

(2) Utilities – (XLU)*(5) Communication Services – (XLC)*(1) Consumer Staples – (XLP)*(3) Financials – (XLF)*(4) Real-Estate – (XLRE)*(7) Industrials – (XLI)*(6) Healthcare – (XLV)*(9) Technology – (XLK)*(8) Materials – (XLB)*(11) Consumer Discretionary – (XLY)*(10) Energy – (XLE)*

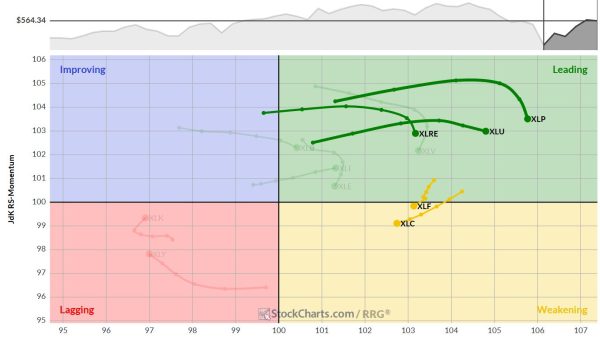

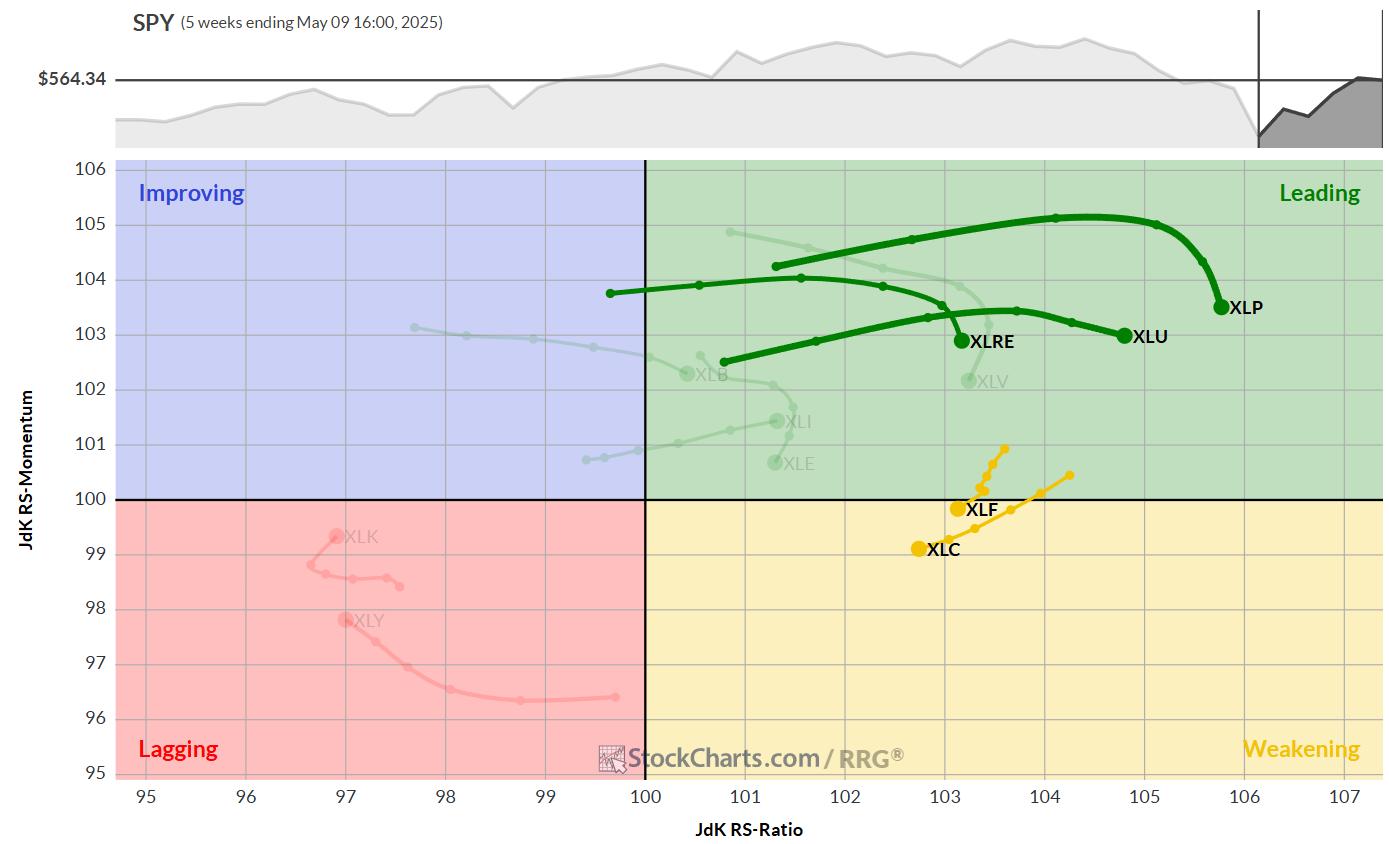

Weekly RRG

On the weekly Relative Rotation Graph, we’re seeing some interesting movements:

Staples, Utilities, and Real Estate remain in the leading quadrant, but are losing some relative momentumFinancials and Communication Services have moved into the weakening quadrant — but with high RS ratio values and room to potentially curl back up.

Daily RRG

Shifting to the daily RRG, the picture looks a bit different:

Communication Services stands alone in the leading quadrant, moving with a strong RRG headingStaples, Utilities, Real Estate, and Financials are all in the lagging quadrant — but importantly, they’re starting to curl back up.

This combination of weekly and daily RRG tails supports these sectors maintaining their top-five status despite some short-term weakness.

Utilities

It’s interesting to see Utilities — arguably the most defensive sector — take the top spot against a backdrop of strong overall markets.

The price chart shows ongoing struggles with overhead resistance, but relative strength continues to rise, cementing Utilities as the current sector leader.

Communication Services

This sector made an impressive leap from 5th to 2nd place.

Price action shows a strong rally, now holding well above the former support-turned-resistance level just below 95.

Relative strength remains within its rising channel, and while the RRG lines are pushing through the weakening quadrant, there’s still room for a potential curl back up.

Consumer Staples

Staples remains range-bound between roughly 77.5 and 82.5.

This sideways movement is reflected in both relative strength and RRG lines.

The RS ratio is at its highest level in over two years — we’d have to go back to May/June 2020 to see similar strength for this sector.

Financials

The Financials sector is holding up well, though it’s approaching the former rising support line that could now act as resistance.

Relative strength remains upward within its trend channel, keeping the RRG lines stable.

The RS ratio remains near 103, positioning Financials on the right side of the RRG.

Real Estate

Real Estate saw a slight drop last week, stalling its recent rally.

This impacts relative strength, with the raw RS line moving sideways and momentum rolling over.

The RS ratio line’s rise is slowing as a result.

Portfolio Performance

Our model portfolio composition remains unchanged this week.

We’re tracking about 3% behind the S&P 500 year-to-date, which is not unusual, looking at the backtest results. And it has not changed since last week.

Evaluating this strategy over longer periods is crucial to determining its true potential.

I am planning to write a separate article diving a little deeper into this model and its historical results, showing periods of over- and underperformance and how it has managed to outperform the S&P 500 over extended timeframes.

#StayAlert. –Julius